The Illustration Development Team is excited to announce that all Indexed Universal Life plans are available to be inforce illustrated!

You'll find an updated look with new features to immediately generate inforce Compass Elite IUL and EquiFlex IUL illustrations.

Features include:

- The ability to make immediate and future changes for:

- Premium

- Specified Amount

- Death Benefit Option

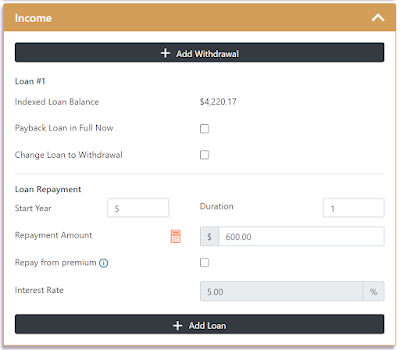

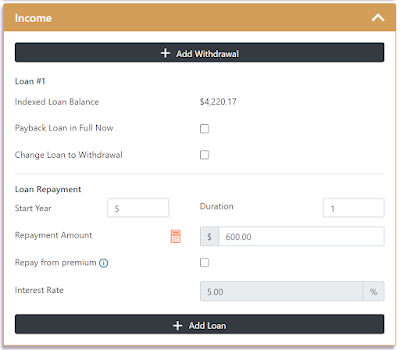

- A Loan Payback Section with a repayment calculator.

- The ability to illustrate all riders and edit rider amounts.

To run an IUL inforce illustration, hover over Illustrate in the top menu bar and click on Inforce Search.

On the inforce search screen, enter the indexed universal life policy number and click the Search button. The policy will be pulled up if you are the assigned agent for the policy.

This will take you to the summary screen where the basic information of the policy can be viewed. The policy can be inforce illustrated if it has been in force for at least a year and the policy is at or above the minimum specified amount.

Click on Inforce in the left-hand menu to go to the input screen. From here you can run a current inforce illustration or make hypothetical changes to the policy. Within the Output box, click Quick View to generate and view the results on the screen and click Download to generate the illustration as a PDF.

To make a hypothetical change to the premium, specified amount or death benefit option, check the Change checkbox within the section. This will allow different changes to be made including changing the current amount, entering a schedule, or using a calculator.

Within the Income box, a new withdrawal or loan can be added by clicking the Add Withdrawal and Add Loan buttons. If the policy has an existing withdrawal or loan, the information will be listed within this section as well. Some of the options available for an existing loan are illustrating paying back the loan in full now, changing the loan to a withdrawal, editing the loan repayment, and calculating the required repayment amount to pay off the loan in a certain number of years.

All riders the policy has will be listed within the Riders box.

Click on the rider name to view detailed information about the rider or to make changes to the rider. Just like the other sections, click the Change checkbox to edit the rider amount or to add a rider schedule, if applicable. Clicking the Cease Rider checkbox will hypothetically remove the rider from the policy.

An exciting new feature within the inforce system is the ability to transfer a case from the inforce system to the new business system. If you have a client that wants to apply for a new plan, clicking New Business makes this process easy! All of the client's personal information is transferred to the Illustration System and E-App, but we don't transfer any of the policy information. Once transferred to the Illustration System, pick the new product that you and the client decide on and review the personal information to make sure it is up-to-date.

We hope this helps in servicing your clients! Please contact us if you have any questions about running an inforce Compass Elite IUL or EquiFlex IUL illustration on iKCLife.

Have a Great Day,

Illustration Development Team

1-800-572-2467 x8162

illustrationhelp@kclife.com