The

Life Protector & Valued Assured Crossover Point Wizard is now available on iKCLife!

To use the new wizard sign in to iKCLife. Once signed in click on the Wizards tab and then the Life Protector & Value Assured Crossover Point link.

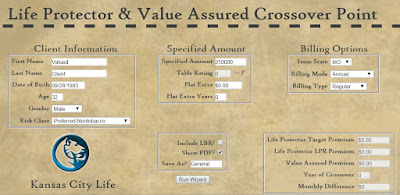

The first step for the wizard is to fill out the client information, specified amount, and billing options sections.

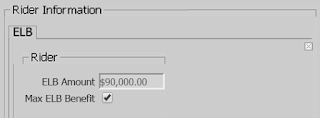

After these sections are completed there are some optional things that can be added. To include the Living Benefits Rider or generate the full crossover point PDF check the applicable box. Like all of the wizards on iKCLife every case is automatically saved so a descriptive name can be entered in the Save As? box to easily find previous cases. Clicking the Run Wizard button will produce the results.

Below is a sample set of results. This section includes the annual amount for the Life Protector Target and LPR Premium and the Value Assured Premium. The PDF generated always uses the LPR premium so each case will run to age 120. The target premium was included to easily see what the commission would be on the case. In this particular case the target and LPR premium are the same but a difference in these premiums will happen in certain cases. The Year of Crossover is the point at which the client will have paid less for Value Assured coverage then for Life Protector coverage. The Monthly Difference shows the monthly difference in premium between the Value Assured and Life Protector.

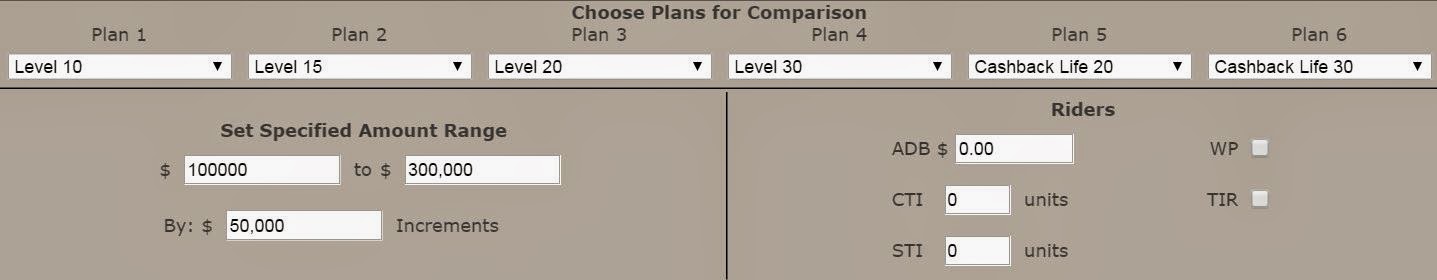

If the Show PDF? box was checked an illustration like below will be generated.

Two columns that don't show up on a base illustration are Total Net Cost and IRR. Total Net Cost is the total net outlay should the client drop coverage at the end of the policy year. It is the sum of the premiums paid less any cash value returned at surrender. The IRR represents the before-tax rate of return if the difference between the Life Protector and Value Assured premiums were invested for a specified number of years and the Value Assured cash value was returned at the end of those specified years.

Please contact us if you have any questions on the Life Protector & Value Assured Crossover Point Wizard or if you would like to walk through running one together.

Have a Great Day,

Illustration Development Team

1-800-572-2467 x8162