Earlier this month we released the last of our annuities into the Quick Quoter, the SelecTracks! There are three different versions of the product: the SelecTrack 5, 7, and 10. Follow along as we highlight some of the key features of this product.

To get started, we will cover a few basic descriptions of the product. The SelecTracks are redeterminable guaranteed interest rate annuities. What that means is the initial guaranteed interest rate is set at issue for each policy and applies until the end of the surrender charge period. This period is equal to the number after the SelecTrack. For example, the SelecTrack 5 has a surrender charge period of 5 years.

Once the policy has gotten past the surrender charge period, there are a few options that the client could take:

- withdraw the accumulated value of the policy as a lump sum;

- select one of the available payout options;

- leave the value of the annuity policy on deposit at an interest rate determined annually; or

- apply for a new SelecTrack policy with a new interest rate guarantee period and new surrender charges

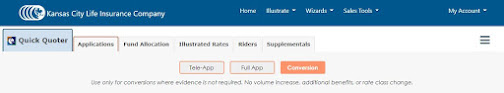

Now, head on over to the Quick Quoter and check out our newest addition, the SelecTrack Annuities!

Please don't hesitate to contact us if you have any questions or need help with any step of quoting our annuity products!

Illustration Development Team

1-800-572-2467 x8162

illustrationhelp@kclife.com