Our Quick Quoter calculators make it easy and fast to figure out how much premium should be paid for a given case setup on universal life products. Through the calculators, you can calculate the premium amount that needs to be paid for the policy to provide coverage or endow in a given year or at a given age. Keep reading to learn how to calculate a premium using our PT calculator (available on all universal life products except Life Protector).

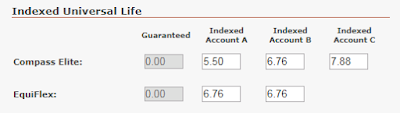

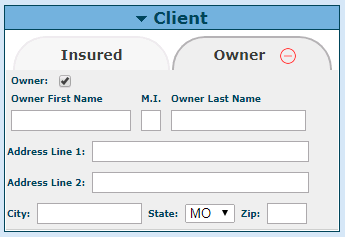

Once you have navigated to the Quick Quoter, choose a universal life product and fill out relevant insured information.

Next update the values section with the desired specified amount, DEFRA option, and death benefit option.

Finally, add any riders you want to be included in the case setup.

Now you are ready to calculate the premium. Choose the appropriate billing mode and billing type, and then click the "PT" icon to the right of the premium field to open the premium to age or year calculator.

Now you should see the calculator inputs.

You have the option to complete the calculation based on either amount of years in the future, or the future age of the insured.

If you would like to complete the calculation based on future year, leave the By Year radio selected. If you would like to complete the calculation based on the age of the insured, select the By Age radio and skip down to the "Calculation Type - By Age" section below.

Calculation Type - By Year

Pay Through Year - determines how far into the future the insured will pay the premium. If the insured will pay for the entire life of the policy, this should match the "Achieved at End of Year field that we will discuss later. If the insured would like to pay up the policy in a shorter time frame, such as ten years, update this field to that amount.

Target Cash Value - determines how much cash value will remain in the policy in the year set in the "Achieved at End of Year" field. We suggest leaving the $1,000 amount if you want the policy to provide coverage through your entered year and no longer. If you would like to see the policy endow in this year, update this field to be the same as the entered specified amount.

Achieved at End of Year - this is the year in which the policy will have the amount of cash value entered in the "Target Cash Value" field.

Mortality/Expenses and Interest Rate - this field determines if the calculation will be completed under current or guaranteed assumptions.

Once you have updated these fields, click Calculate. The calculator box will close and the resulting premium will be entered into the Premium field.

Calculation Type - By Age

Pay Through Age - determines until which age the insured will pay the premium and the age in which the policy will have the cash value in the "Target Cash Value" field.

Target Cash Value - determines how much cash value will remain in the policy in the year set in the "Pay Through Age" field. We suggest leaving the $1,000 amount if you want the policy to provide coverage through your entered year and no longer. If you would like to see the policy endow in this year, update this field to be the same as the entered specified amount.

Mortality/Expenses and Interest Rate - this field determines if the calculation will be completed under current or guaranteed assumptions.

Once you have updated these fields, click Calculate. The calculator box will close and the resulting premium will be entered into the Premium field.

Please let us know if you have any questions!

Illustration Development Team

illustrationhelp@kclife.com

1-800-572-2467 x8162