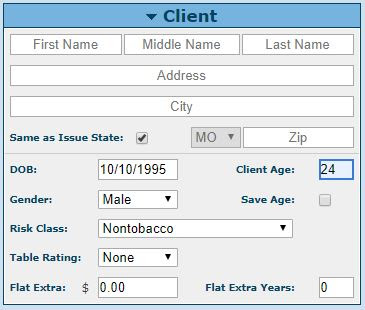

The Quick Quoter's user-friendly interface makes it very easy to enter all of your client's personal data and add any premium schedules, payout options, or income schedules related to the case. Payout options now include Life, Certain and Life, Certain Specified Period, Specified Certain Amount, Installment Refund, Joint and Survivor Life, and Joint and Survivor Certain and Life.

The entire layout of the illustration PDF, including the Lifetime Income Rider (LIR) detail page, has been streamlined for clarity and readability. You will notice that the payout option details can now be seen at the bottom of the "Quick View" summary output making it faster than ever to approximate your clients' future income without having to first generate the entire illustration.

As always, you can access specific product details and additional agent information in the Product Portfolio.

Please let us know if you have any suggestions that would improve your experience in illustrating the SecurityTrack or any other products on the Quick Quoter by contacting us at IllustrationHelp@kclife.com.

As always, happy selling!